What is Stop Loss and the types of Stop Loss Orders

We understand the Forex market is extremely volatile and unpredictable and it will prove us wrong many times! Also, the influencing factors on Forex Market are unpredictable; we need to establish an understanding of how to protect our equity and reduce losses. Stop Loss orders help to reduce major losses and ultimately protect equity.

We must admit the losing side is part of the game but at the same time, our winners should outcast our losses. All successful traders preach the importance of stop loss and today we will discuss this in detail.

Stop Loss

Stop Loss is a level or price on which we exit from the trade. As mentioned, we determined this level, before executing the trade. Sometimes we use Swing Low/High for stop-loss point and sometimes it’s just a previous candle low/high. There is no hard and fast rule but generally, the stop-loss price level is well far from the market fractal point or resistance. We will discuss trading strategies in a separate article.

Now let’s take an example of USDJPY pair and understand the stop loss level.

Consider the above picture and look into section “A”. The market is moving between 107.030 and 107.174. We establish our understanding that the market will go down once it breaks the previous resistance price of 107.030. Since we are establishing our bias towards the Short/Sell trade, we will place a stop loss on the above level. If we are predicting the market will move low, what if the market can prove us wrong and go in the opposite direction. So to cover that scenario, we choose the previous swing high point and in this example, the price level at swing high is 107.174.

FXCM broker quotes two digits after the decimal point for JPY pairs.

Stop Loss in Pips = 107.174 – 107.030 = 0.14

To calculate stop loss, we will first subtract the low price (107.030) from the higher price (107.174) and this will give us the difference of 0.14 points. So in another word, our pip difference between the entry point and stop loss is 14 pips.

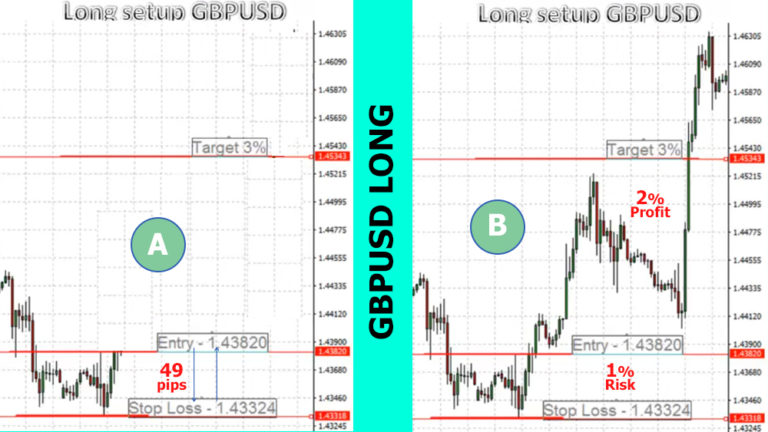

Now let’s take an example of long or Buy Trade.

The above picture shows in Section “A” the price is moving between 1.43820 and 1.43318. We are anticipating the break of price level 1.43820, we will trigger Buy/Long trade. And to the stop loss will be previous swing low at price 1.43318. now to calculate Pips, we will use the same formula and it will return 49 pips. FXCM quotes 0.001 (3 digits) after the decimal for non-JPY pairs.

Stop Loss in Pips =1.43820 – 1.43324 = 0.00496 (hence 49 pips)

I hope the stop loss and stop loss pips concept is clear. Now let’s understand the different types of stop-loss orders that are available for trading.

What is a market Order

Market Order is the simplest form of order that is available on any trading platform. It open a trade at market value instantly. Let’s understand this in more detail. If we want to enter in market either short/long or sell/buy trade instantly, we can open market order. There are two types of market order that covers both short and long side of the trade.

What is a Buy Order

Buy order means that we want to open a trade with anticipation of the market will rise from the current price. This is executed instantly at market price. Traders also use the term “Long” trade which means execute a Buy trade. It gives us market entry to go long or to make a profit from rising Forex or Stock prices.

What is a Sell Order

Sell order means that we want to open a trade with anticipation of market will go down from the current price level. This order also gets executed instantly at market price. Another term that is use for Sell order is “Short” trade. This order type gives us opportunity to enter in market instantly to make profit from falling Forex or Stock prices.

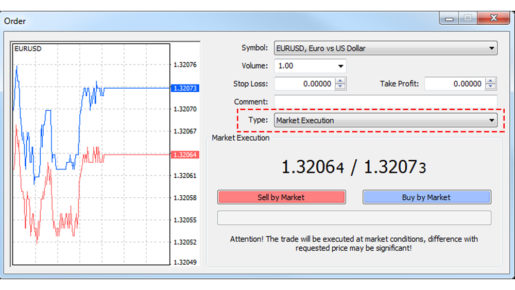

How to place Buy Order in MT4

The above example is an MT4 platform and the options are very much the same in almost all trading platforms. We will select Type “Market Execution” and will click the “Buy by Market” button. Obviously, we have selected the Volume (Lot Size) and stop-loss price and take the profit price as per the trading plan.

Once we will click Buy by Market button, it will open a long or buy trade for EURUSD (Symbol) pair of 1 lot at price of 1.3207.

How to place Sell Order in MT4

To place a sell order on an MT4 platform, the same steps are involved. First, select the type of order to “Market Execution”. Select the volume (Lot size) you want to trade and press the “Sell By Market” order. This will open sell trade at a price of 1.3206.

There are also other types of orders to suits trader’s different needs or demands. Let’s discuss them one by one. Among these the most common two types are Stop and Limit orders. These orders are set in advance before the price reaches to those levels. In other words, these are also called pending orders.

What is a Limit Order

Limit order is also called pending order. Most professional traders use this approach to determine the market entry point before the price reaches that level. Let’s understand this with example.

Limit Order Example EURUSD

EURUSD pair current price is 1.11397. At this price, we are establishing our hypothesis that in the future the price will either cross 1.12196 towards up or either it will cross downward 1.10601 level.

So we can place rather than waiting for the market to go those prices and we hit trade, we can set pending limit orders either for buying or sell.

In short, the limit orders are pending orders that are defined well before the market reaches to those price levels.

What is Buy Limit Order:

Buy limit orders are pending orders that are set blow the current price level. Usually when the markets retraces, that’s where the limit buy orders are place. Let’s understand this with example.

Buy Limit Order Example

As shown in the above picture, the EURUSD current price is 1.11392. Since the trend is up as display with the red line, we can are anticipating that after the price drop or retrace, the EURUSD price will go up again. For this, we set the Buy Limit Order at the price level 1.10601 and place stop-loss orders at a price of 1.09728 (previous swing low).

Now we are anticipating that in near future, the price will drop to 1.10601 and that’s where our buy limit order will trigger which have already put in place sometime (days) before. At the same time, we want to cover the “what if” scenario. What if the market prof us wrong and rather than going up, it takes further down and reverses the trend. For this, we have place stop loss and we don’t want to be in this trade once the price touch 1.09728.

I hope the buy limit order concept is fully cleared. Now let’s talk about sell limit scenario.

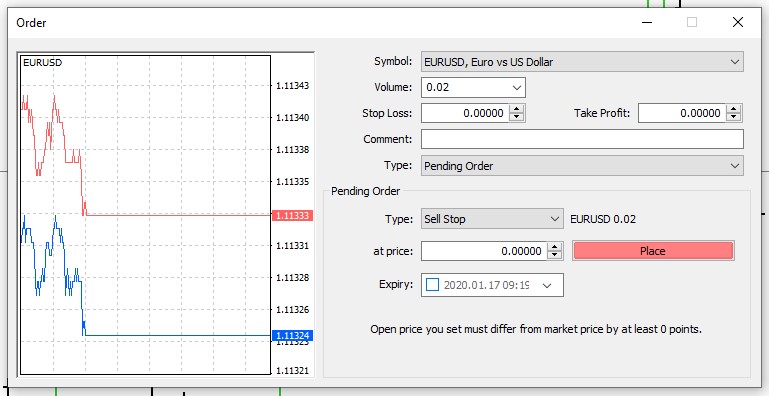

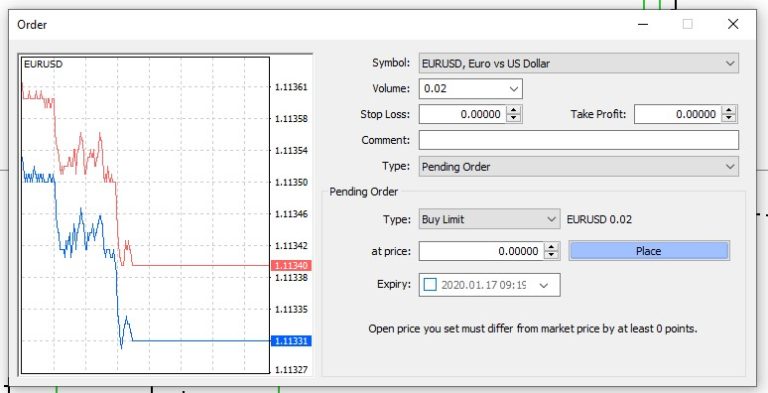

How to setup Buy Limit Order in MT4

Once we open the MT4 place order window, we need to change the Type to Pending. This will display further options for “Pending Order” below. The below picture example demonstrates this. There in the Type section, we can select Buy Limit as order type and write the price at which we want to place pending order in the “at price” section.

Similarly, it shows the Stop Loss and Take Profile section too and we can fill that according to our trading plan. Once these details are in, we can place this order by pressing Place button.

I hope the buy limit order concept is fully cleared. Now let’s talk about sell limit scenario.

What is Sell Limit Order:

Sell limit orders are pending orders that we place above the current market price. If the trend is down and we anticipate the market will go further down. We place sell limit order at above the current price of market. These means when the market retraces back, our sell order will get trigger and we will continue on downward trend. Let’s understand this with an example.

Sell Limit Order Example

As shown in the above picture. Taking the example of EURUSD chart again, the current market price is 1.11392. Now we are anticipating the market Is exhausted cause it is not making significant higher highs. We are building our hypotheses that the market will go down and for this.

For this, we set a sell limit order at the price of 1.12016 which is above the current market price. Also at the same time, we place a stop-loss order at the price of 1.12600. This is to cover the “what if” scenario and protect the losses.

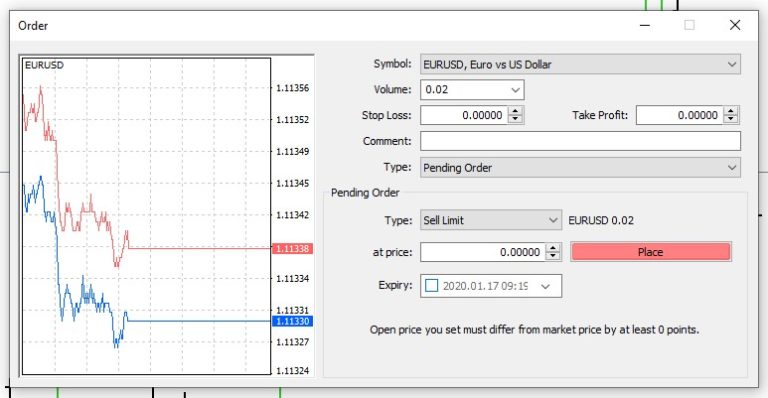

How to setup Sell Limit Order in MT4

To place a sell limit order, the steps are the same. First, we open the MT4 order window and select “Pending Order” in the Types section. This will give us additional features below and we can select Sell Limit in the drop down and set the price at which we want this order to get trigger.

Above picture demonstrate the sell limit order fields and also we can set stop loss and take profit as per our trading plan.

What is stop limit orders

Stop limit orders are type of pending order and we use them either above or below the current market price of currency or stock. Either we anticipate that market will go up and we want to place buy ahead of market or the market will go down and we place sell order ahead of market. Let’s understand this with help of example.

What is buy stop order

Buy stop orders type of pending orders and we place it ahead of current market price. We anticipate that market will go up and we place buy stop order at certain price.

Buy Stop Order Example

As shown in the above picture, the EURUSD market is trading at 1.0994 and we are building a hypothesis that the market will go up on the break of upper resistance. In the above picture, Redline is displayed as resistance. We set a pending Buy Stop order at a price of 1.11813 ahead of market movements. If the market breaks above the resistance which is 1.11800, it will trigger our buy stop order at 1.11813. Obviously, we can set a stop at the previous swing low or as per our trading plan. Now let’s understand, how to place buy stop order in MT4 with an example.

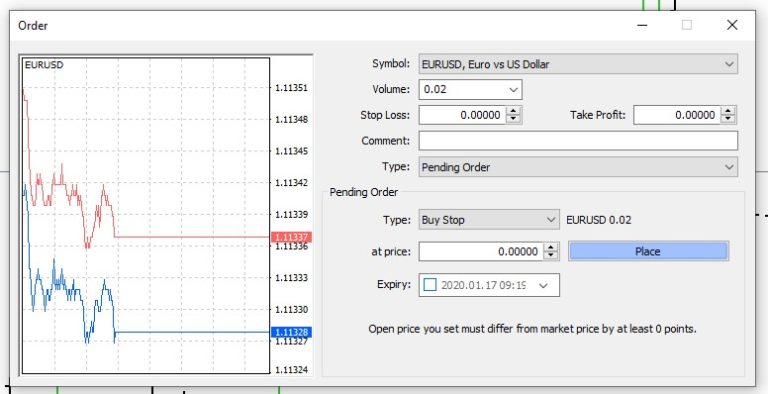

How to place buy stop order in mt4

First, we will open the Order window and select “Pending Order” in the Type field. As shown in the picture below, we will select the Buy Stop option in the order type dropdown and enter the price at which we want this order to be triggered.

At the same time we can place stop loss and take profit prices as well as part of our trading plan. As explained above, the pending buy stop order will always be above the market’s current price. I hope this is now clear and let’s look into sell stop orders.

What is sell stop order

Sell stop orders are type of pending order and we place below the current market price level. When traders anticipate the market will go further down at certain price level, that’s where they place pending sell stop order way before the price reaches to that level. Let’s understand this with an example.

Sell Stop Order Example

As shown in the above picture, the EURUSD market is trading at 1.11015 level. We anticipate that market will go down further once it breaks the resistance. Resistance is a display with a red solid line. Since we are thinking this price will go down further to the resistance, we place a pending sell stop order at the price of 1.10789 which is below the current market price.

This pending sell stop will only trigger if the market breaks the red line. Now let’s see how we can set this order in MT4

How to place sell stop order in mt4

In order to set sell stop, first we will open MT4 terminal and open Trade Window. We will select “Pending Order” in Type section. As shown in the picture below, we will select order type to Sell Stop in type section and enter the price at which we want this order to be trigger.

As shown in above example, the sell stop order is always place below the current market price. At this stage we can also set the stop loss and take profit price as per trading plan.